If you enjoyed our last installment of the best GEICO commercials you should enjoy these gems just as much, if not more!

Full Coverage Insurance for Families

Family auto insurance policies are often the best solution in situations where there is more than one driver in the household. By grouping all of the drivers into a single policy, you can make sure that each one benefits from the same amount of coverage and you are also likely to get a better price than if you were to get an individual policy for each member of the family that drives.

Including a Teenager in Your Policy

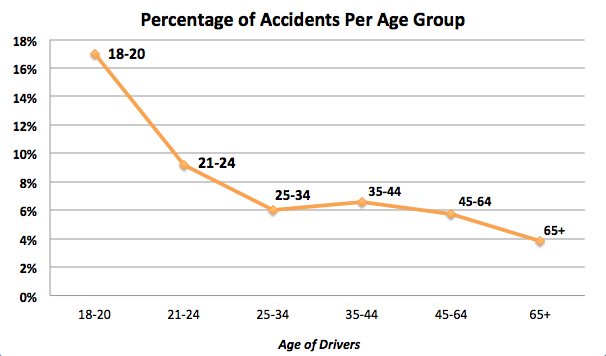

The most common situation where a family policy is most beneficial is when one of your teenage children starts driving. In terms of price alone, you will save a lot of money on premiums since getting an individual insurance policy for a teenager is very expensive. The main reason for this is because they are inexperienced and therefore more likely to cause an accident. Statistics show that teenage motorists are responsible for a large amount of fatalities due to their lack of experience, but also because they tend to drive fast and are prone to getting distracted. According to the National Highway Safety Traffic Administration drivers between the ages 18-20 were responsible for 17% of all accidents in 2012. (source http://www.distraction.gov/content/get-the-facts/research.html )

However, just because other teens drive dangerously does not mean that yours will, so if you want to save money then it would be a good idea to put them on your insurance policy. Depending on the insurance provider you use, you might even have access to other discounts to lower your monthly premium even more. For example, a lot of insurers will offer a Teen Driver Pledge discount. Basically, it means that if your child takes a pledge to drive safely and also has a high grade point average at school, then you will get a discount. The reasoning behind this is that if your children get good grades and behave well at school then it is more likely that they will also be safe and responsible behind the wheel.

Another option would be to take a safe driving course. If you complete such a program and then present a certificate to your insurer, it will almost always result in a discount. This is a very good idea for a teen driver who is just starting to drive, but it can also be useful for experienced adults who have a spotty safety record that can cost them high premiums each month.

Advantages of a Family Policy

As mentioned, by having a family insurance policy, all the members of your household will be protected equally. This means that you need to consider carefully what kind of coverage you will include in your policy. For example, if a teenager is included in the policy, it is highly advisable that you get collision coverage. This will pay for repairs to your car should it be involved in an accident where the driver is at fault (which has a high probability of happening with an inexperienced teenage driver).

One particularly useful feature of a family policy is the ability to easily add or remove a driver from the policy without having to cancel or renegotiate it. In a family with children, this is particularly useful when a child goes away to college. You can even arrange it so the policy only applies when they return back in town by specifying which months of the year your children are allowed to use the car.

Multi Car Discounts

If, however, you decide that it is best for each member of the family to have their own individual insurance policy, you can still benefit from a discount by getting all of the policies from the same insurance provider. Most of them will offer a Multi Car discount for two or more cars owned by the same family so be sure to check the prices of various carriers before deciding.