Cheap Full Coverage Auto Insurance in California

updated: July 5, 2020 –

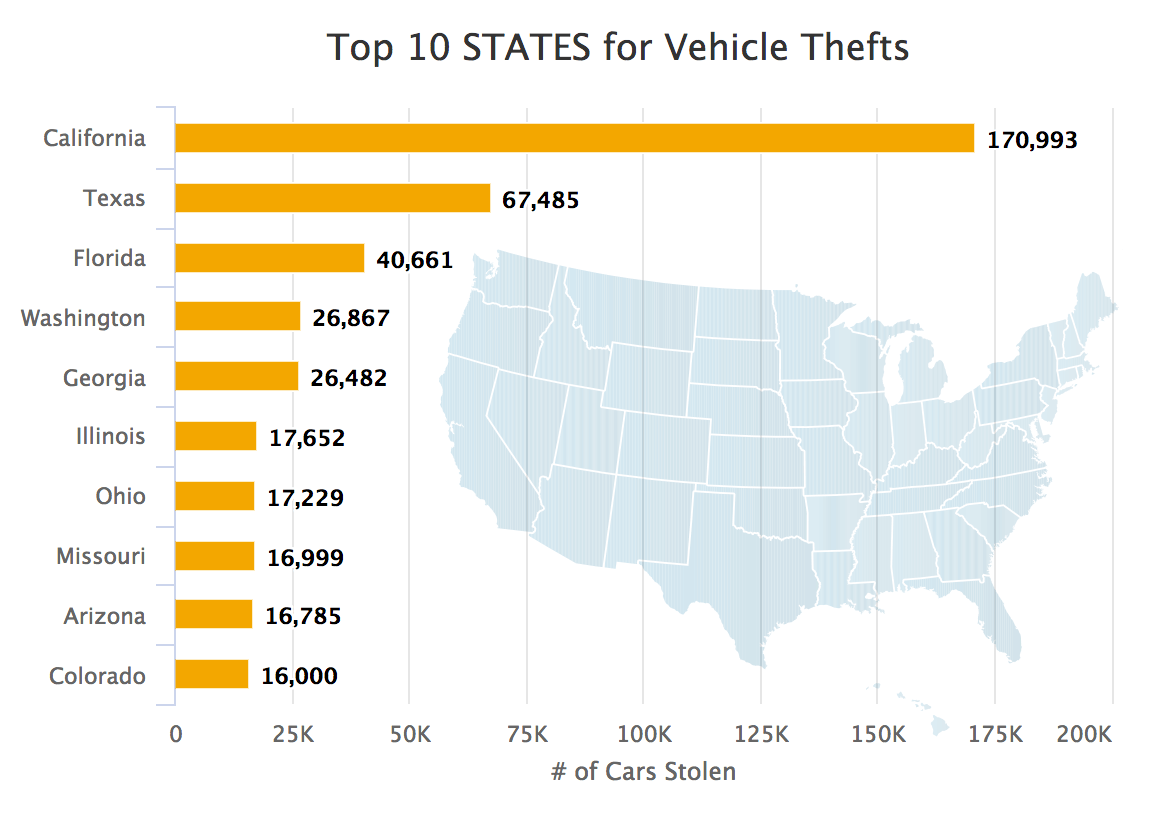

Considering that California tops the charts when it comes to car thefts, and also happens to be the state where the most accidents occur, it’s no surprise that Californians are interested in the benefits of full coverage auto insurance.

Find Cheap Full Coverage Auto Insurance

Superior Protection

A full coverage policy’s comprehensive and collision coverages offer California drivers very needed protection against the pervasive theft and accidents found in California. A California state minimum liability policy will simply not include these protections.

Full coverage also comes with protections against acts of vandalism or damages caused by nature. In addition to these basic services, a full coverage policy can also include other features such as Personal Injury Protection (PIP) or Uninsured Motorist coverage. This however, is up to each insurer individually. With so many different forms of coverage such a policy can get quite expensive and too much for some drivers to afford.

However, finding cheap full coverage auto insurance is a possibility provided you know where to look and make strategic coverage choices.

What motorists need to understand is that there are many factors which will affect their monthly premiums on insurance. Understanding them all will give you a better chance of making them work in your favor.

California State Requirements

The minimum amount of liability insurance California requires is “15/30/5” for private passenger vehicles. This means the driver must have a minimum coverage of $15,000 for bodily injuries to another person, $30,000 for bodily injuries to another two or more people and $5,000 for property damage.

Many states have very low limit requirements and California is one of them. However, simply purchasing a policy with the lowest possible minimum requirements is not the recommended way to lower your full coverage insurance rates. The reason is that it is extremely easy for an accident to exceed most state minimum limits, which is why it is always recommended to chose much higher coverage limits. $100.000 per person, $300.000 per accident and $100.000 for property damage is what insurance companies usually suggest.

As you can imagine, choosing higher limits will inevitably raise your insurance premiums, which might make you wonder, if I choose higher limits how can I get cheap full coverage insurance?

Make Insurers Compete

There are certain aspects which can work towards your benefit if you want generous coverage at a good price. First of all, you can take advantage of the fact that it is a buyer’s market out there. There are plenty of competing insurance companies offering their services so it is in their interest to lower their rates and attract more customers.

The best place to start is by using our free insurance quotes comparison search engine. Just enter your zip code below and click ‘Compare Quotes Online’.

Find Cheap Full Coverage Auto Insurance

Adjust Your Deductible

Another way to get a better deal on full coverage insurance is to take advantage of your deductible. A deductible is a predetermined sum that drivers have to pay whenever they want to make a claim with their insurance provider. This is usually around $250 to $500. However, you have the option of selecting an even higher deductible.

While this might seem counterproductive, since you will be forced to pay that amount if you have an accident, a higher deductible is worth considering. It’s a good way to lower your monthly premium without subjecting you to the ruinous risk of being forced to pay hundreds of thousands of dollars out of your own pocket if you are unfortunate enough to cause an accident that greatly exceed your policy’s limits.

Who has the Cheapest Auto Insurance in California?

| Full Coverage | Monthly at 10,000 miles | Monthly at 15,000 miles |

|---|---|---|

| Safeco | $173 | $207 |

| Mercury | $189 | $201 |

| Progressive | $190 | $212 |

| Allstate | $209 | $259 |

| Esruance | $210 | $233 |

| 21st Centruy | $220 | $254 |

| Nationwide | $235 | $269 |

| State Farm | $239 | $244 |

| Hartford | $257 | $296 |

| AAA | $258 | $266 |

| Liberty Mutual | $333 | $385 |

In our 2018 price comparison study, the cheapest companies for full coverage insurance in California were Safeco, Mercury, Progressive and Allstate. However, since every driver’s situation is different, we always recommend comparing quotes before deciding on any carrier.

Our study’s methodology:

*Rates did not include standard deductions such as multi-policy, multi-car, good student, safety features etc., which can greatly reduce monthly rates.

Coverage – included Liability, Comprehensive & Collision (Full Coverage), at these levels:

– $100,000/$300,000 Bodily Injury

– $50,000 Property Damage

– $5,000 Medical Payments

– $30,000/$60,000 Uninsured/Underinsured Motorist – Bodily Injury

– $250 Comprehensive Deductible

– $500 Collision Deductible

– Waiver on Collision Deductible

Driver’s Profile – Honda Accord driven by a 25 year old woman who has been a licensed driver for 7 years with no traffic violations.

Companies Included in Study – 21st Century, Allstate, AAA, Esurance, Hartford, Liberty Mutual, Mercury, Nationwide, Progressive, Safeco and State Farm.

California Cities Included – Monterey, San Francisco, Butte and Humboldt Eureka (premium rates were averaged to provide a cross section sampling across California)