If you enjoyed our last installment of the best GEICO commercials you should enjoy these gems just as much, if not more!

Top 10 Ways to Invalidate Your Auto Insurance Policy

(updated: Jan. 23, 2017)

The last thing you want to find out after having an accident is that the auto insurance policy you’ve been faithfully paying every month has been nullified.

There are many things that can render your auto insurance completely invalid. Here is a handy list of the 10 most common:

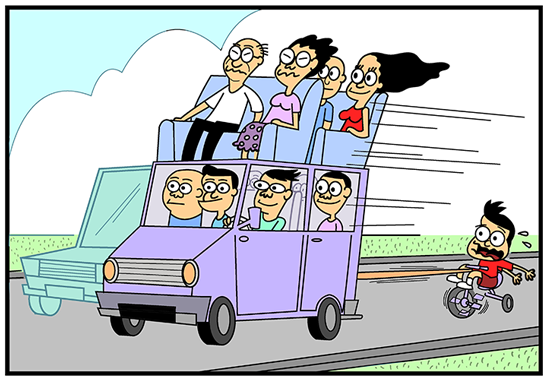

1) Overloading your vehicle with more passengers or weight than it’s been rated for

Yes, exceeding your vehicle’s passenger and weight limits can leave you and your vehicle completely unprotected.

2) Driving after your drivers license has expired

All auto insurance policies include a clause stating that the person driving the vehicle must have a valid and current drivers license. Thus, driving with an expired license is basically like driving without car insurance at all.

3) Driving without your glasses

…when it has been established you need them to drive safely.

4) Using your car in ways you haven’t indicated in your insurance policy

For example, if you’ve claimed that you only use your car for “social, domestic and pleasure”, but in actuality use it to commute to work, this could invalidate your policy as well.

5) Insuring your car under the name of a driver who isn’t the primary driver

This is called “fronting” and is a tactic used to lower premiums by using the name of someone who is a lower risk driver than the actual driver and is also grounds for your insurance company to refuse an insurance claim.

6) Not disclosing accidents you’ve had in the past

These will always be found when you file a claim and will render your insurance as valuable as the paper it’s printed on.

7) Providing a different address than your actual address

Some are tempted to do this because they live in a high risk area and because of this provide the address of a lower risk area to lower their insurance rates. However, oops, this will invalidate your policy too.

8) Driving through a flooded area of the road

Doing this can fall under “driver negligence” and invalidate the Comprehensive part of your insurance policy.

9) Underestimating your mileage

When you apply for an auto insurance policy, take the time to calculate how far you drive your car every year. For example, if you live 10 miles from work, you will most likely drive 20 miles every weekday, which is 100 miles per week. In this case, fair estimate of how many miles you drive every year would be at least 4800. However, if you think you might save a few bucks by writing 1000 miles per year on your insurance application, you will be underestimating the correct figure substantially. Insurance companies state that providing this kind of gross misinformation on your insurance application has the potential to invalidate your policy.

10) Admitting that you are liable for an accident you’ve been involved in

Contractually, your insurance company is the only one who has the right to decide who is liable for an accident. In addition, making any commitments that can be interpreted as admitting liability, such as agreeing to pay for damages caused by an accident, also can invalidate your policy. This is why you should never admit an accident was your fault even if you think it was. It’s best to let your insurance company and police authorities come to those conclusions.